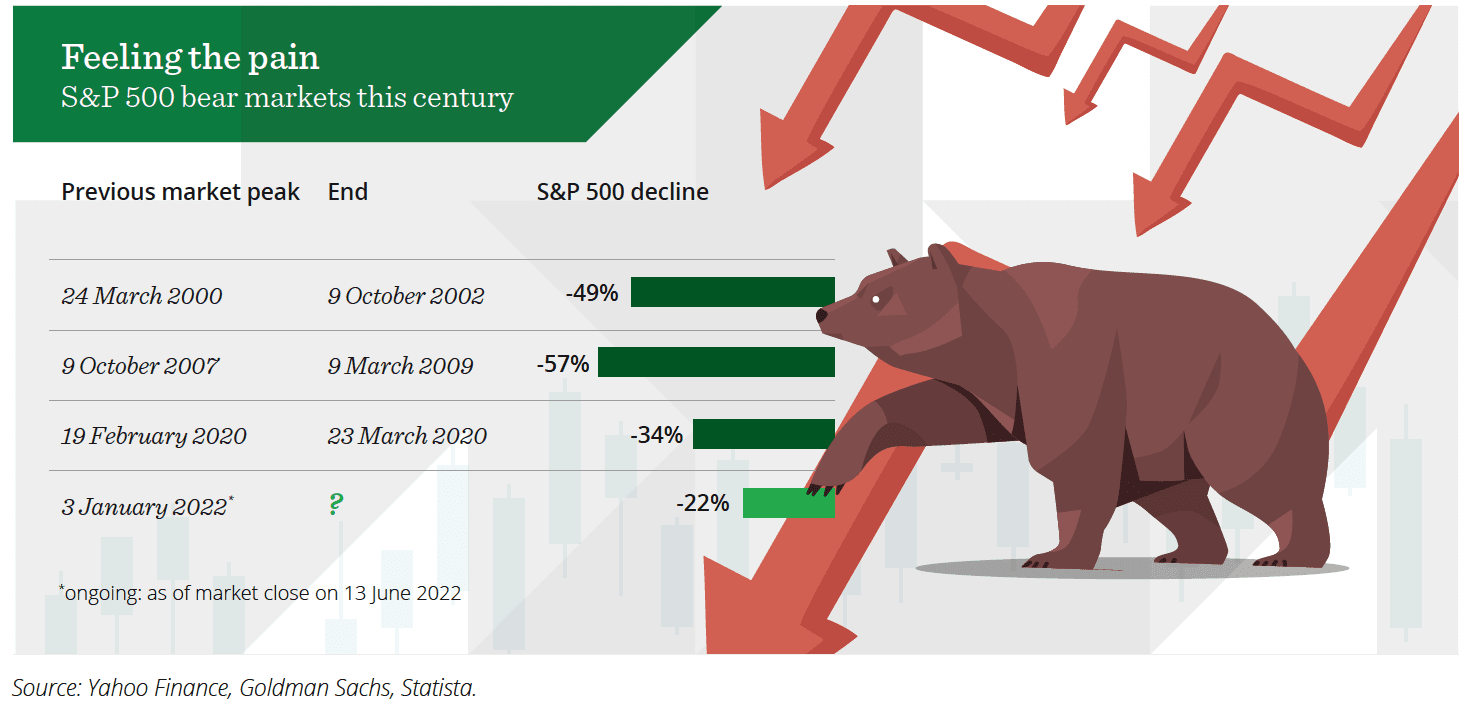

Year of the bear: S&P 500 enters bear market territory

On Monday 13 June the S&P 500 Index entered bear market territory for the first time since the pandemic crash in March 2020, with the index down 22% from its peak on 3 January. This is the fourth bear market phase for the S&P 500 this century.

Turkey’s mounting inflation crisis

Annual inflation in Turkey hit a two-decade high in June of just under 80% with food prices doubling and transport costs up well over 120%. Meanwhile, Turkey’s currency, the lira, has plummeted more than 20% against the US dollar since the start of the year.

Turkey’s president, Recep Erdogan, attracted headlines back in September when he insisted that, contrary to established economic theory, the country’s high interest rates were, in fact, driving inflation higher and that its central bank must continue to cut interest rates, even as prices were rising.

Consequently, while central banks elsewhere have been raising interest rates to combat inflation, which has the effect of supporting their currencies, Turkey has been doing the opposite with interest rates locked at 14% since last December.

Mr Erdogan continues to blame Turkey’s economic problems on foreign interference.

Last week he announced that the minimum wage would rise another 30% this month after hiking it 50% at the start of the year.

Surging energy prices knock euro back

On Tuesday (5 July) the euro slumped to a 20-year low, falling 1.3%, while Japan’s yen fell to levels not seen since the late 90s. Currency markets recoiled from a 17% jump in European natural gas prices and data showing European business growth decelerated sharply in June.

Elsewhere, news of a strike by Norwegian offshore workers, that will further curtail supplies, added to the looming fears of energy shortages and recession in Europe.

Thanks to the US Federal Reserve’s (Fed) aggressive interestrate hiking cycle, and its status as the world’s reserve currency, the US dollar hit a two-decade high on Tuesday.

Despite local interest rates rising at their fastest pace for 26 years with a second consecutive 0.5% increase on Tuesday, the Australian dollar also fell around 1% to be down around 7% in 2022. This has already led commentators to warn of the risk of “reverse currency wars”, a scenario where central banks are forced to keep hiking rates just to support their currencies.

Important Information

This communication is for information purposes only. Quilter Investors uses all reasonable skill and care in compiling the information in this communication ad in ensuring its accuracy, but no assurance or warranties are given by Quilter Investors or Kind Wealth.

You should not rely on the information in this communication in making investment decisions. Nothing in this communication constitutes advice or a personal recommendation. Any opinions expressed in this communication are subject to change without notice.