China’s long march

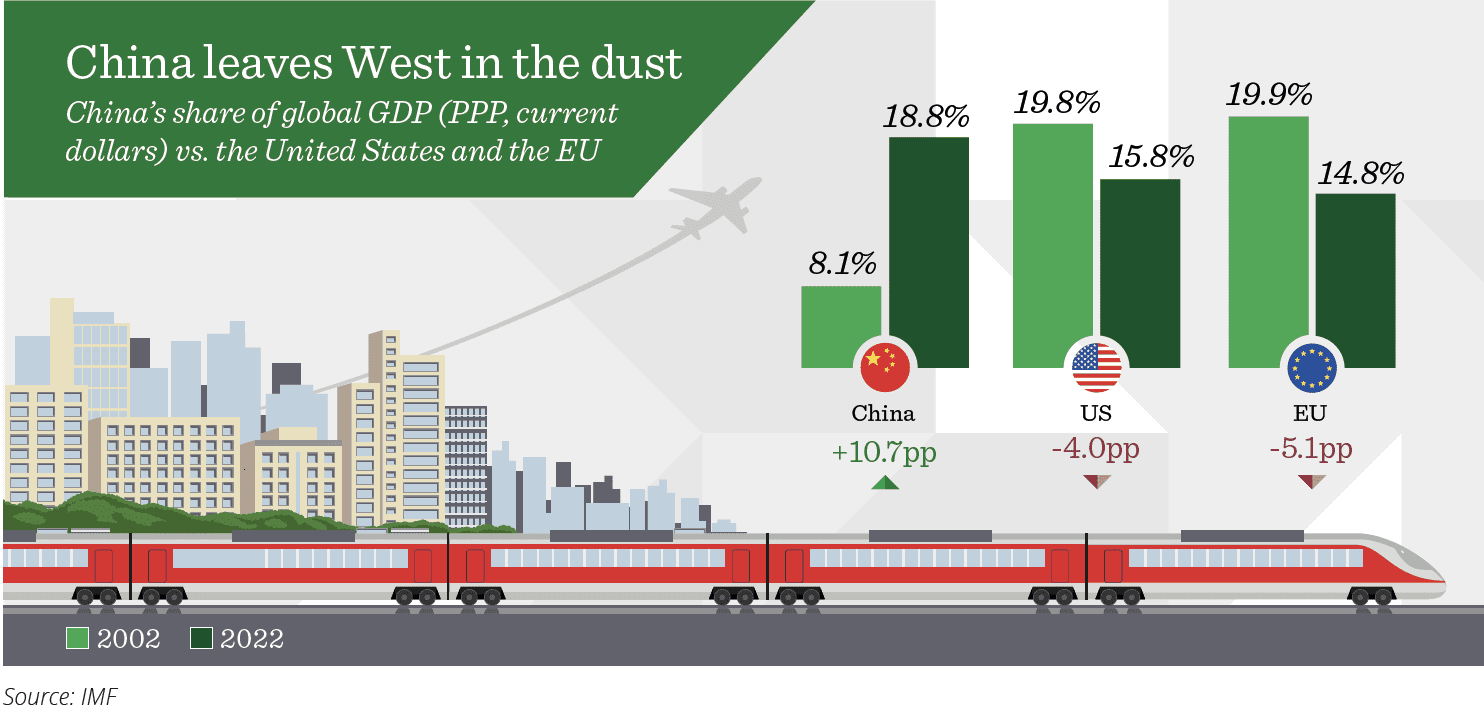

According to data from the IMF’s latest World Economic Outlook, this year China will account for 18.8% of global GDP based on purchasing power parity (PPP). That’s more than a 10% jump from just 20 years ago. Over the same period, the US share of global GDP dropped 4% while Europe’s fell 5.1%.

Running on empty: gas price crisis quietly worsens

Late last week, the whole European gas price curve ominously repriced to a much higher level showing that the current energy crisis will likely get worse before it gets better, especially as the winter months loom.

In simple terms, this means both companies and households can expect to pay far more for their ongoing energy costs than was forecast only a week or two ago. Following the invasion of the Ukraine, European gas prices jumped to all-time highs in March reflecting what was expected to be a short-lived crisis. However, the latest forward pricing curve shows that the market now expects the crisis to continue through 2023 and into 2024.

Europe’s manufacturers are already feeling the strain as the cost of hedging their energy costs for 2023 has almost doubled since March. Meanwhile, industry analysts now forecast that, from October, UK households will pay as much as £3,244 a year for their gas and electricity, an increase of nearly 65% from prior to the Ukraine invasion.

Bank of England: UK inflation to be back on target in two years

On Monday (11 Jul) Andrew Bailey, governor of the Bank of England (BoE), told a parliamentary committee that he expected to see UK inflation fall sharply next year, much in line with the bank’s forecasts from early May.

UK inflation hit a 40-year high of 9.1% in May with the BoE forecasting it would peak at just over 11% in October of this year when the country’s regulated power tariffs are reset at far higher levels.

Mr Bailey estimated that UK inflation would be back to the bank’s 2% target in about two years while pointing out that added household energy spending would likely dampen consumer spending elsewhere. However, Russia’s ongoing manipulation of European gas markets, or more persistent domestic cost pressures, could change that, he warned.

To fight inflation, the BoE has so far raised UK interest rates five times in 0.25% increments, but investors now foresee almost a 70% chance of a 0.5% rate hike on 4 August.

Important Information

This communication is for information purposes only. Quilter Investors uses all reasonable skill and care in compiling the information in this communication ad in ensuring its accuracy, but no assurance or warranties are given by Quilter Investors or Kind Wealth.

You should not rely on the information in this communication in making investment decisions. Nothing in this communication constitutes advice or a personal recommendation. Any opinions expressed in this communication are subject to change without notice.