Helping you invest

We’re here to help preserve and protect your wealth. To help you we have answered some of the questions you may have and recommended some simple steps for you to follow when markets may appear a little more volatile.

Is it worth getting advice?

A financial adviser will talk to you about your current situation and what you want to achieve for you and your family. They can then give you advice and a plan that’s tailored specifically for you. This plan can help you to stay focused on your long-term aims without being distracted by short-term market changes. In turbulent times, advice provides an objective view, giving you peace of mind, so it may just be the best investment you ever make.

How long should I invest for?

Many people believe that knowing when to buy and when to sell is the secret of successful investing. The truth is that no one knows with certainty when markets will rise or fall. Trying to time the market is very seldom successful. It’s far better to use time to your advantage. The sooner you can start investing, and the longer you can invest for, the more likely it is for you to achieve your financial goals, regardless of any short-term blips.

When’s the best time to invest?

A financial adviser can help you decide when the best time is for you to invest. However, the earlier you invest the better. It’s important not to be put off when markets are at a low point because stocks may be cheaper to buy at this time. The magic of compounding – the ability to grow an investment by reinvesting your returns – can help to generate wealth. The difference of just a few years can have a massive impact on the end result, so start early if you can.

What should I invest in?

A diversified portfolio of a range of different assets can help to iron out the ups and downs of stock markets and also help avoid exposing your portfolio to undue risk. When one asset class is performing poorly others may be flourishing, and vice versa, so avoid concentrating your investments in just one area. If you notice that the value of your investments has reduced, take your time, stick to your plan, and avoid making any hasty decisions.

Your three-step plan

1. Get financial advice

2. Take time to think things through

3. Make sure your investments are diversified

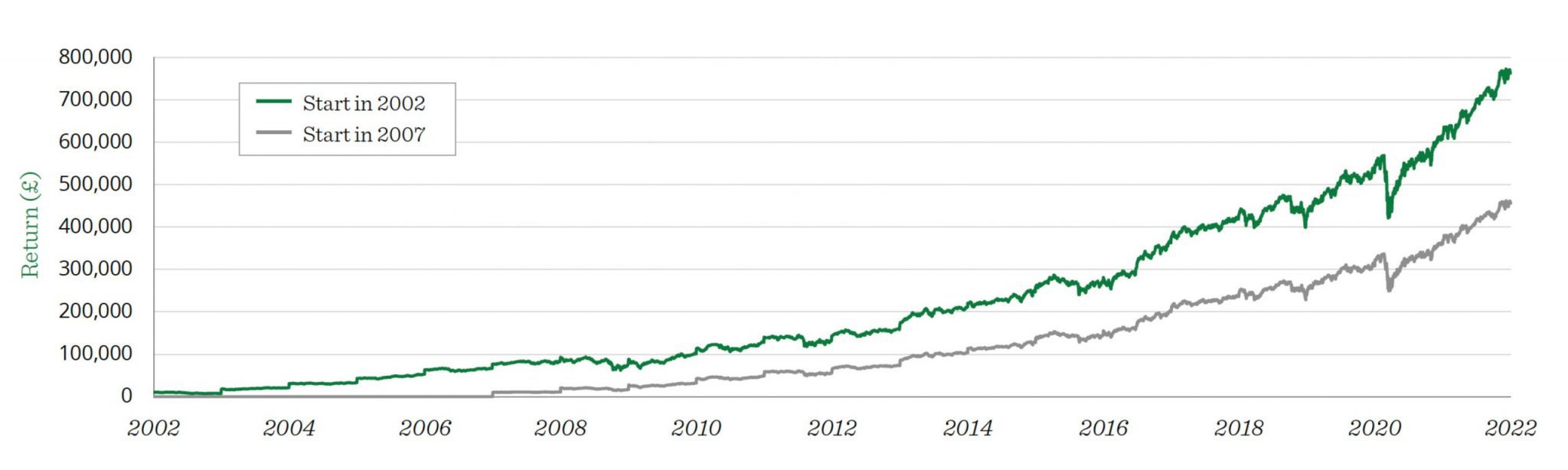

The advantages of investing early

Compound interest – earning interest on your interest – can have an incredible effect on an investment portfolio.

The chart below shows the benefits of investing earlier, as an investor could have accumulated £306,631 more than someone who started investing five years later, even though they have both invested the same £10,000 every year. If the other investor wanted to accumulate the same pot after 20 years, they would need to invest £16,721 each year!

Key takeaways

The benefits of diversification

By spreading your investment across different asset types, it is possible to avoid exposing your portfolio to undue risk.

The jumble of colours below – with each colour representing a different asset class – shows how varied the performance of different investment assets (such as equities, bonds, and property) has been over the last 10 years. There is no guarantee that the sector that is top in one year will perform well the next.

Key takeaways

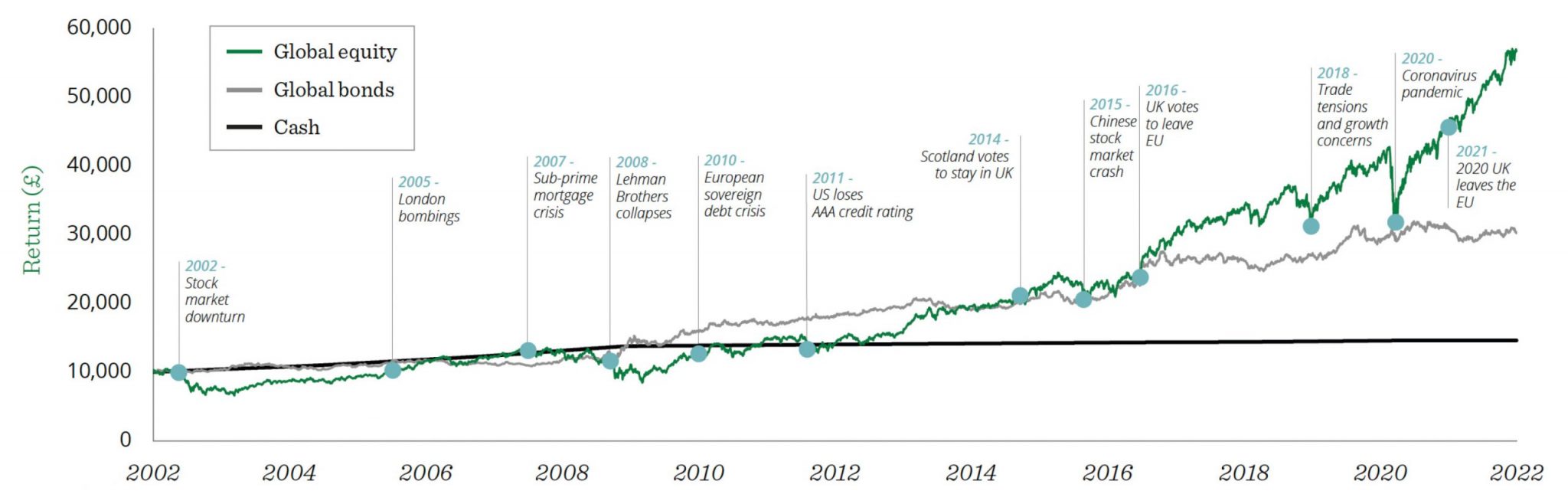

The importance of investing for the long term

Investing with a long-term outlook is the best way for you to reduce the impact of stock market fluctuations and to grow your investment over time.

The chart below shows that over the long term, there is an upward trend of returns from equities and bonds, despite the short-term volatility caused by major events. In fact, if you invested £10,000 on 31 December 2000, you could have seen your investment grow by nearly 500% when investing in global equities.

Key takeaways

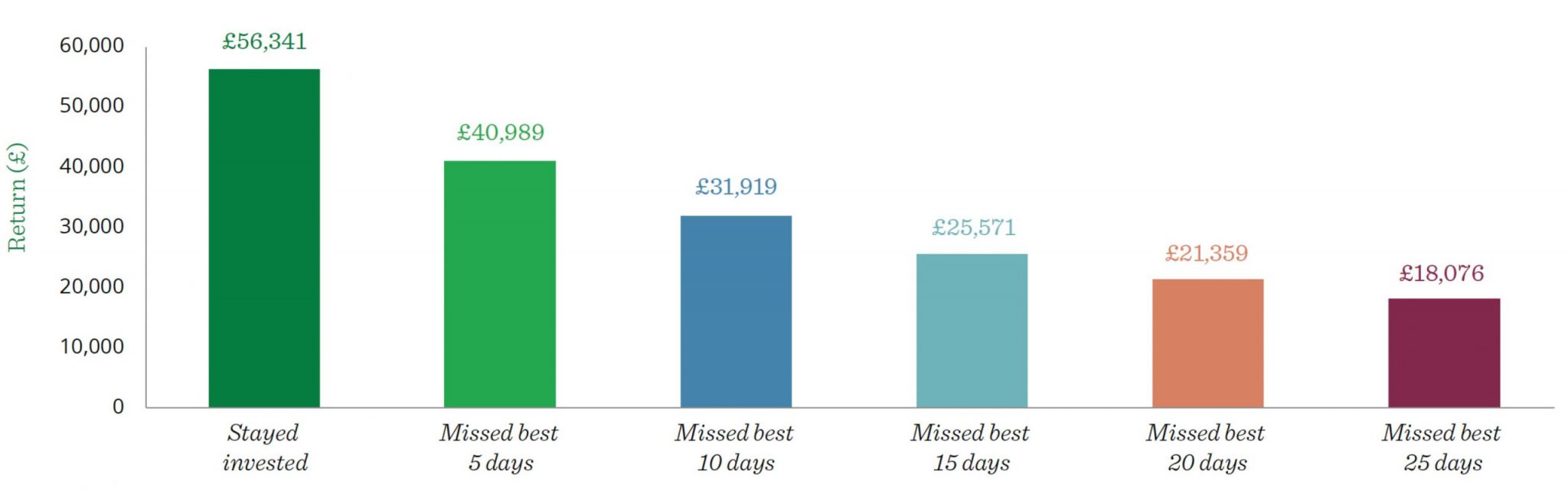

The reward of staying invested

During periods of volatility it can be tempting to exit the market but missing just a few of the best days can have a big impact on your overall return.

The chart below shows that if you had stayed invested in global equities over the entire period, you could have had a potential return that was three times greater than that of an investor who missed the best 25 days during the same period, based on both of you investing £10,000.

Key takeaways

Please note

The value of pensions and investments, as well as the income that they produce, can fall as well as rise. You may get back less than you invested.

Past performance is not a guide to future performance and may not be repeated. Investment involves risk. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested. Because of this, an investor is not certain to make a profit on an investment and may lose money. Exchange rates may cause the value of overseas investments to rise or fall.

This communication is issued for information purposes only. Quilter Investors uses all reasonable skill and care in compiling the information in this communication which is accurate only on the date of this communication. You should not rely upon the information in this communication in making investment decisions. Nothing in this communication constitutes advice or personal recommendation. This communication should not be constructed as a solicitation or an offer to buy or sell any securities or related financial instruments in any jurisdiction.