Our monthly economic review is intended to provide background to recent developments in investment markets as well as to give an indication of how some key issues could impact in the future.

It is not intended that individual investment decisions should be taken based on this information; we are always ready to discuss your individual requirements. We hope you will find this review to be of interest.

UK economy expands in May

The latest gross domestic product statistics show that the UK economy unexpectedly grew in May although forward-looking indicators still point to a deteriorating outlook.

Figures released last month by the Office for National Statistics (ONS) revealed that the economy returned to growth in May after contracting during April. In total, UK economic output rose by 0.5% across the month, significantly exceeding the consensus forecast from a Reuters poll of economists which had predicted zero growth.

ONS said the main sectors of the economy all expanded during May including construction, travel and manufacturing. The data also revealed significant growth within health services as one of the key drivers of growth during the month.

In spite of May’s rebound, analysts still expect the economy to come under increasing pressure in the coming months as the cost-of-living squeeze weighs heavily on households’ ability to spend. Recent survey evidence also points to weaker growth, with July’s preliminary headline reading of S&P Global’s Purchasing Managers’ Index recording the weakest rise in UK private sector business activity for 17 months.

Commenting on the findings, S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said, “Economic growth slowed to a crawl in July, registering the slowest expansion since the lockdowns of early-2021.” And he added, “Forward-looking indicators suggest worse is to come.”

The latest economic forecasts from the International Monetary Fund suggest the global economy is also facing ‘an increasingly gloomy and uncertain outlook’. The international soothsayer now predicts global growth will slow from 6.1% last year to 3.2% in 2022 and 2.9% in 2023, downgrades of 0.4 and 0.7 percentage points from April’s projections. The UK is expected to be particularly hard hit, with growth next year forecast to be just 0.5%, the weakest among the G7 nations.

Inflation at 40-year high

Official statistics show consumer prices are rising at their fastest rate in four decades fuelling expectations of another base rate hike when the Bank of England (BoE) concludes its next monetary policy meeting in early August.

ONS data released last month revealed that the UK’s headline rate of inflation rose to 9.4% in June, the highest recorded level since February 1982. This was up from the previous month’s rate of 9.1% and slightly higher than analysts’ expectations.

Motor fuels and food were the biggest upward contributors to June’s figure. ONS said average petrol prices rose by 18.1p per litre, the largest monthly increase since records began in 1990, while the cost of milk, cheese and eggs all climbed sharply and the price of vegetables, meat and ready meals also rose notably.

The jump in inflation increased the chances of a sixth successive rate hike when the BoE’s Monetary Policy Committee (MPC) next convenes. The MPC is due to announce its decision on 4 August, with speculation of a half percentage-point rise intensifying following recent comments by the Bank’s Governor Andrew Bailey.

During a Mansion House speech the day before June’s inflation data was released, Mr Bailey reiterated that the MPC is ready to “act forcefully” if it sees signs of greater inflation persistence. “In simple terms, this means that a 50 basis point increase will be among the choices on the table when we next meet,” Mr Bailey said.

However, the Governor also made it clear that such a rise was “not locked in”. And a Reuters poll published towards the end of July suggests the MPC’s decision will be an extremely close call, with just over half of the economists surveyed predicting a 25 basis point rise and the remainder all saying they expect a 50 basis point hike.

Markets (Data compiled by TOMD)

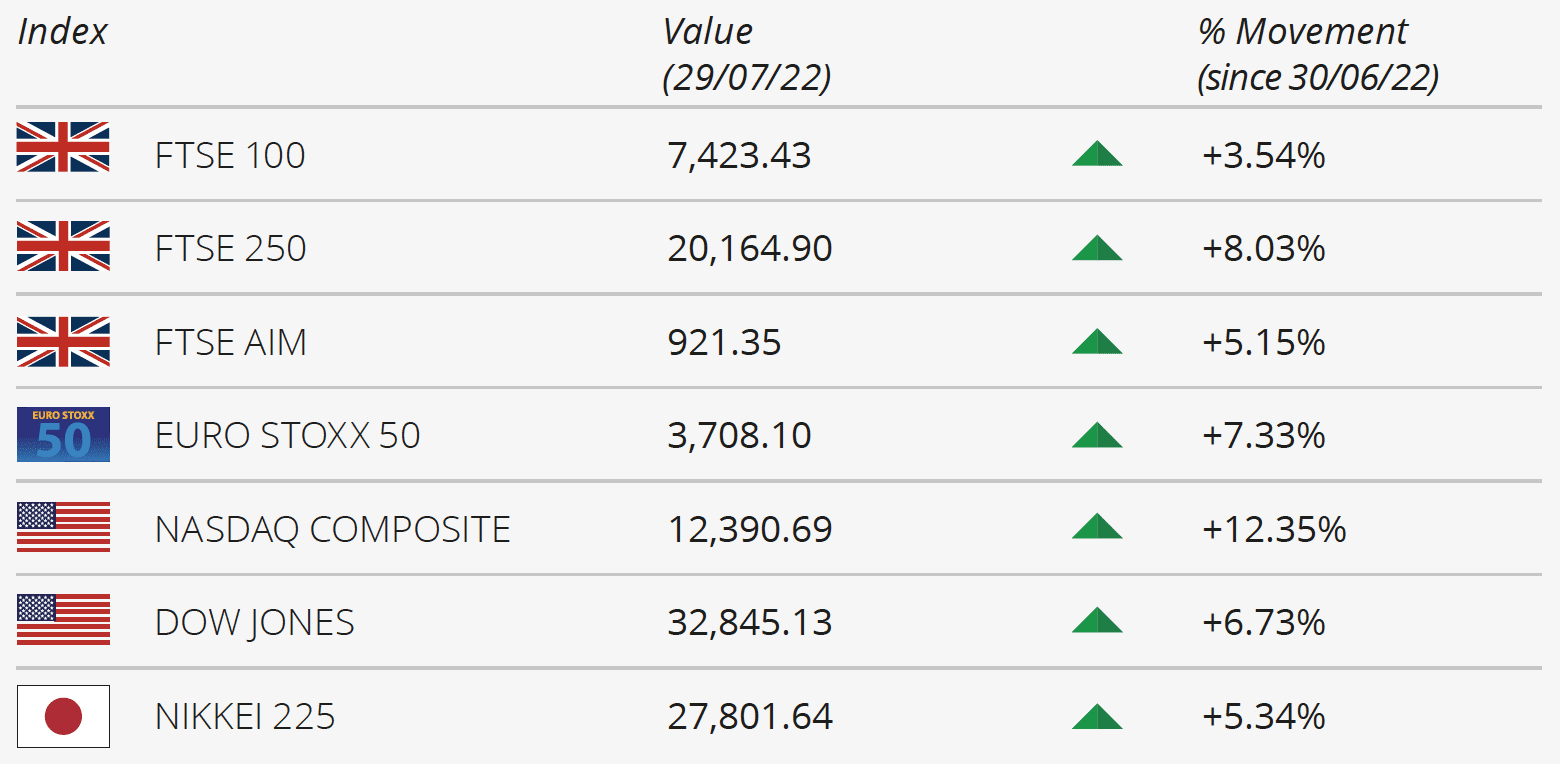

Global stocks have rebounded from a poor first half of 2022, as easing rate rise expectations and upbeat earnings from big tech groups fuelled a broad rally.

US stocks extended their July rebound on the final Friday of the month, as positive forecasts from Apple and Amazon showed the resilience of giant companies in an economic downturn, with hopes of a less aggressive monetary policy boosting sentiment. The tech-focused NASDAQ finished the month up 12.35% on 12,390.69. The Dow closed the month up 6.73% on 32,845.13.

London stocks closed the month in green after another wave of corporate news, as well as a raft of inflation indicators in the US and surprise positive GDP releases eased fears of an impending contraction in the eurozone. The FTSE 100 closed July up 3.54% on 7,423.43, while the midcap-focused FTSE 250 registered a midcap-focused FTSE 250 registered a gain of 8.03%. The AIM recorded a gain of 5.15% in July.

In Japan, the Nikkei 225 ended July on 27,801.64, up 5.34%. The Euro Stoxx 50 closed the month up 7.33% on 3,708.10.

On the foreign exchanges, sterling closed the month at $1.21 against the US dollar. The euro closed at €1.19 against sterling and at $1.02 against the US dollar.

Brent Crude closed the month trading at around $105 a barrel, a drop of 4.0%. Gold is currently trading at around $1,753.40 a troy ounce, a loss of 3.50% on the month.

Real pay in record fall

While the latest batch of labour market statistics revealed another jump in employment levels, the data also showed regular pay is falling at the fastest rate on record when taking account of inflation.

According to figures released by ONS, the number of people in employment rose by 296,000 in the three months to May, the largest increase since the June to August period last year. The data also revealed that the unemployment rate held steady at 3.8%, while job vacancies continued to rise albeit at a slower pace than in previous months.

The figures also showed that average weekly earnings excluding bonuses rose at an annual rate of 4.3% in the three months to May, a slight increase on the previous three month period. However, once adjusted for inflation, basic pay packets actually shrank, with the average wage now worth 2.8% less than a year ago – the largest fall in real pay levels since records began in 2001.

A significant disparity in private and public sector earnings growth was also reported across the March to May period. While the annual average total pay growth figure for the private sector was 7.2% (before taking account of inflation), the comparable public sector figure was just 1.5%.

Government debt costs soar

The latest public sector finance statistics show that the sharp rise in inflation has pushed interest payments on UK government debt up to record levels.

ONS data released last month showed that debt interest payments jumped to £19.4bn in June, more than double the previous monthly record figure. Government borrowing totalled £22.9bn overall, £4.1bn higher than the same month last year and the second highest June figure ever recorded.

The large increase in debt servicing costs is being driven by the impact of higher inflation on index-linked gilts. Interest paid on such debt rises in line with the Retail Prices Index which hit 11.8% in June and, with inflation expected to continue rising in the coming months, interest payments are expected to remain at relatively high levels.

June’s data also pushed borrowing further ahead of the Office for Budget Responsibility’s (OBR) most recent forecast. The fiscal year-to date budget deficit now stands at £55.4bn, £3.7bn higher than the OBR forecast at the time of the March Budget. Earlier last month, as part of its fiscal risks and sustainability report, the OBR warned that UK debt is on an ‘unsustainable path in the long term’ unless spending is tightened and taxes are raised.

Important Information

All details are correct at the time of writing (01 Aug 2022).

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK.