Our monthly property market review is intended to provide background to recent developments in property markets as well as to give an indication of how some key issues could impact in the future.

We are not responsible or authorised to provide advice on investment decisions concerning property, only for the provision of mortgage advice. We hope you will find this review to be of interest.

Cooling demand slows sales

Demand is cooling in the UK housing market, according to the latest Residential Market Survey published by the Royal Institution of Chartered Surveyors (RICS).

New buyer enquiries slipped to a net balance of -27% in June, a significant drop from the -9% recorded a month earlier. Net buyer enquiries had fallen nationwide for the first time in nine months in May 2022.

Nationally, the volume of sales agreed also dipped in June (-13%), a more pronounced fall than the previous month’s reading (-5%). With new instructions close to flat in June (-1%), twelve-month sales expectations also remain negative (-21%).

In London, buyer enquiries are proving more resilient, bucking the trend to remain in positive territory at +7%. Yet, even in the capital, several respondents to the RICS survey pointed to increasing interest rates and rapid inflation as factors that are likely to slow the sales market in the coming months.

Help to Build applications open

Applications for the government’s Help to Build equity loan scheme are now open, with £150m of government funding committed to helping self-builders achieve their property goals.

The Help to Build scheme will provide loans of between 5% and 20% of costs (up to 40% in London) to people building their own home. Currently, the average deposit needed for self-builds is around 25% of the total land and building costs, which means many with smaller budgets are excluded.

To be eligible for the scheme, the total build costs cannot exceed £600,000 (£400,000 if the land is already owned), while applicants must plan to live in the property as their primary home.

Andrew Baddeley-Chappell, CEO of the National Custom and Self Build Association, welcomes the initiative. He commented,

“Help to Build is important because it opens up custom and self-build as an option to those with smaller budgets and in particular smaller savings. Access to finance is just part of the answer. The key constraint is access to land with permission to build.”

Homebuyers wait longer as conveyancing delays impact

Backlogs in the conveyancing process are forcing more homebuyers to wait longer from the moment of agreeing a sale, new data have revealed.

The pandemic property boom, sparked, in part, by the Stamp Duty holiday introduced in July 2020, put immense pressure on conveyancers. As a result, the average time from an accepted offer to completion is now 60% higher than it was a decade ago, according to Landmark Information Group.

Moreover, over half a million homes are currently sold subject to contract, according to Rightmove, 44% more than in the same time period in 2019. With buyers now facing an average 133-day wait to seal the deal, those wanting to be in their new home by Christmas are fast approaching the cut-off point.

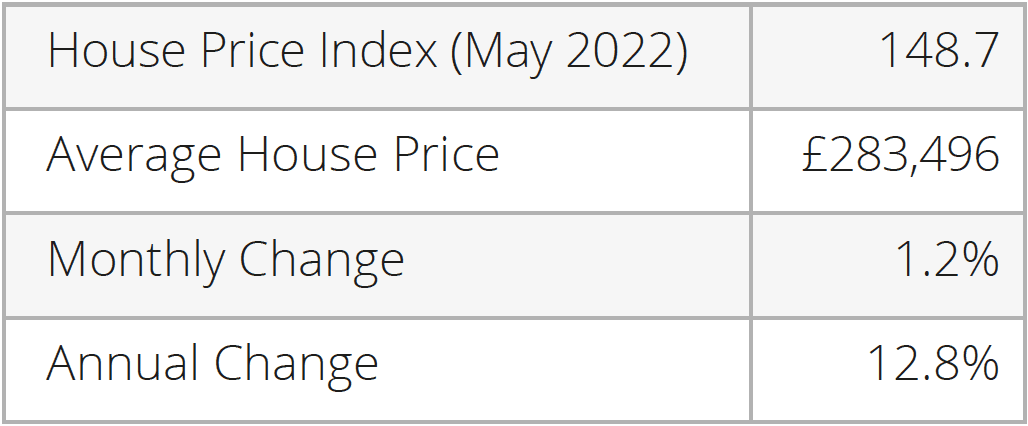

House prices: Headline statistics

Average house prices in the UK increased by 12.8% in the year to May 2022.

On a non-seasonally adjusted basis, average house prices in the UK increased by 1.2% between April and May 2022.

Source: The Land Registry

Release date: 20/07/22

Next data release: 17/08/22

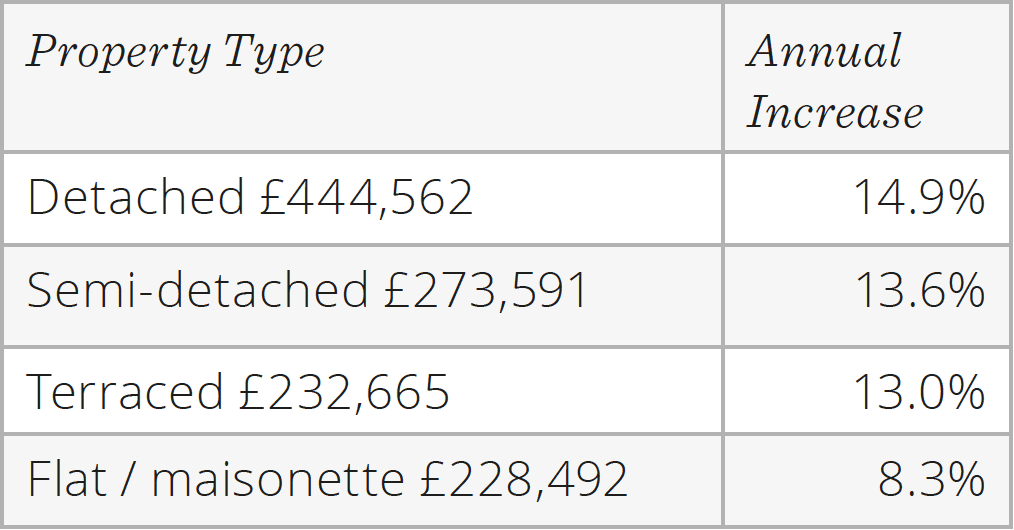

Average monthly price by property type – May 2022

Source: The Land Registry

Release date: 20/07/22

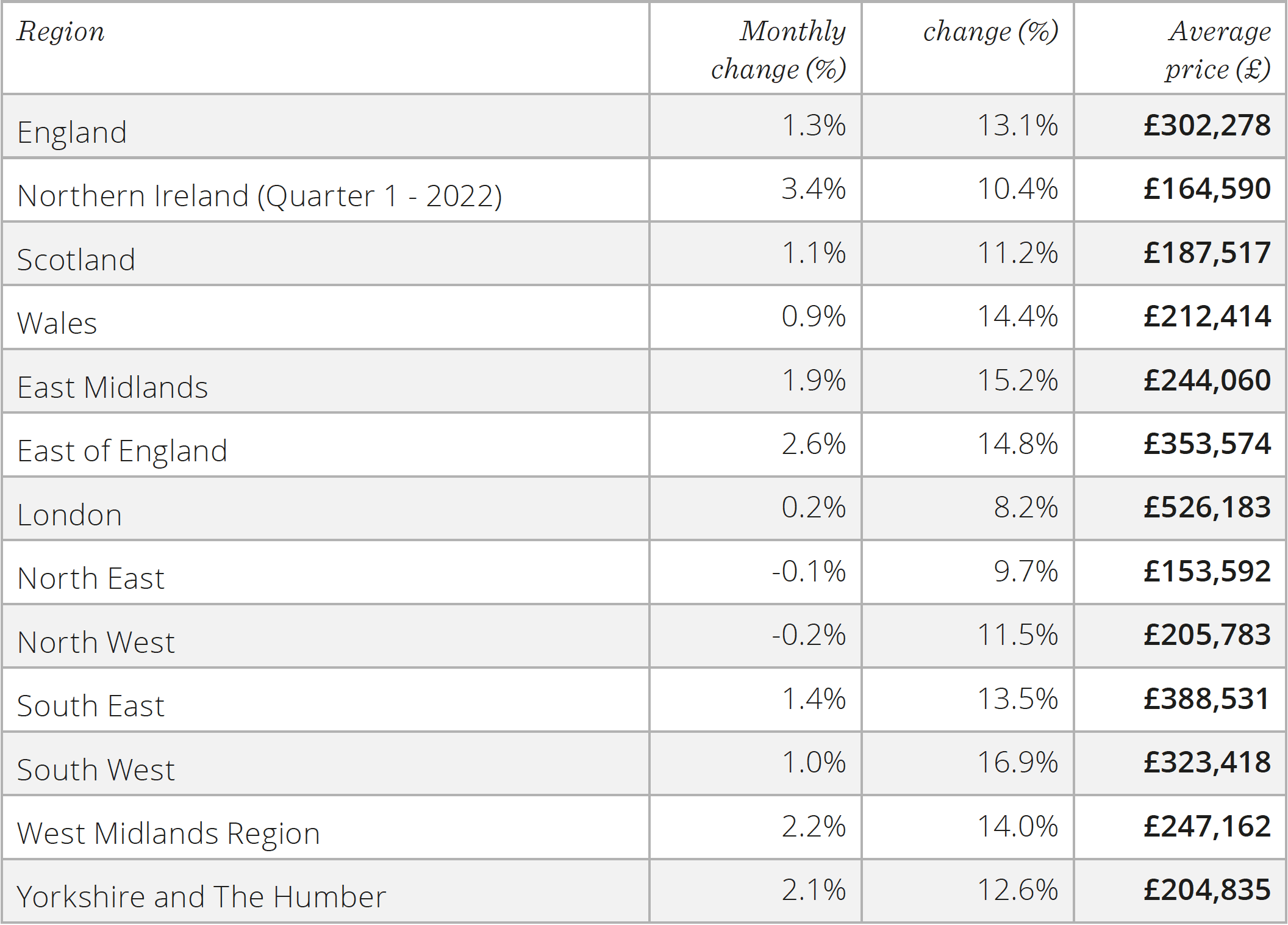

House prices: Price change by region

Source: The Land Registry

Release date: 20/07/22

Next data release: 17/08/22

Housing market outlook

“The supply-demand imbalance continues to be the reason house prices are rising so sharply. Demand is still strong – though activity levels have slowed to be in line with pre-COVID averages – while the stock of available properties for sale remains extremely low.

Property prices so far appear to have been largely insulated from the cost-of-living squeeze. This is partly because, right now, the rise in the cost of living is being felt most by people on lower incomes, who are typically less active in buying and selling houses. In contrast, higher earners are likely to be able to use extra funds saved during the pandemic, with latest industry data showing that mortgage lending has increased by the highest amount since last September.”

Russell Galley, Managing Director at Halifax

Source: Halifax, July 2022

Important Information

All details are correct at the time of writing (21 July 2022).

Contains HM Land Registry data © Crown copyright and database right 2022. This data is licensed under the Open Government Licence v3.0.

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK.