Our monthly property market review is intended to provide background to recent developments in property markets as well as to give an indication of how some key issues could impact in the future.

We are not responsible or authorised to provide advice on investment decisions concerning property, only for the provision of mortgage advice. We hope you will find this review to be of interest.

Our monthly property market review is intended to provide background to recent developments in property markets as well as to give an indication of how some key issues could impact in the future.

We are not responsible or authorised to provide advice on investment decisions concerning property, only for the provision of mortgage advice. We hope you will find this review to be of interest.

Slowing market as demand dips again

The UK residential market continues to slow at a steady pace, the latest Royal Institution of Chartered Surveyors (RICS) Residential Survey and Savills’ Housing Market Update both indicate, as demand wanes and supply remains low.

New buyer enquiries fell for a third consecutive month in July, the RICS report showed, with a headline rate of -25%. This is comparable to June’s reading (-27%) and means the market has now endured the longest stretch of falling demand since the early pandemic days. New instructions, meanwhile, remain stagnant, with a net balance of -5%.

The Savills report paints a similarly slowing picture; total transactions recorded by HM Revenue and Customs were 96,000 for June, 13% lower than the pre-pandemic average for the month. Mortgage approvals were also slightly below average, according to the Bank of England.

One key trend noted by Savills is the increased representation of first-time buyers (FTBs) in the mortgage market.

Almost 31,000 new loans were granted to FTBs in May, according to UK Finance, while new mortgages for home movers fell by 22%.

Crash unlikely despite pressures

A housing crash in 2022 remains unlikely, according to Zoopla, even as house prices come under increased pressure from rising interest rates and living costs.

Despite the pandemic boom, house prices are not as overvalued as they were in previous economic cycles, analysts say. For example, Zoopla’s Richard Donnell points to the tougher rules for getting a mortgage, which “puts the market in a much better position to weather high mortgage rates and the increased cost of living” than in previous downturns.

Furthermore, shifting post-pandemic work patterns can help sustain demand, analysts add. A fifth of people are more likely to move since the pandemic, a Zoopla survey found, while more than half of those expecting to spend more time working from home feel compelled to move. With two-fifths of workers now planning to work mostly from home, according to the Office for National Statistics, that is a sizeable market of potential movers.

Landlords rue new EPC rules

One in five landlords could sell up or stop renting their properties, according to research from Paragon Bank, in response to proposed changes to Energy Performance Certificates (EPCs).

From 2025, all newly rented properties will be required to have an EPC rating of C or above, more stringent than the current requirement of E or higher. Recently, Paragon estimated the average cost of upgrading a rented property to a C rating at £10,560.

Existing tenancies will have until 2028 to comply with the change, after which millions of properties could risk becoming unrentable if landlords don’t make necessary changes.

In the face of these new rules, sustainability is becoming a major selling point, according to Rightmove’s Green Homes Report. The report found that the time it takes to sell a property is faster for homes with the highest EPC ratings.

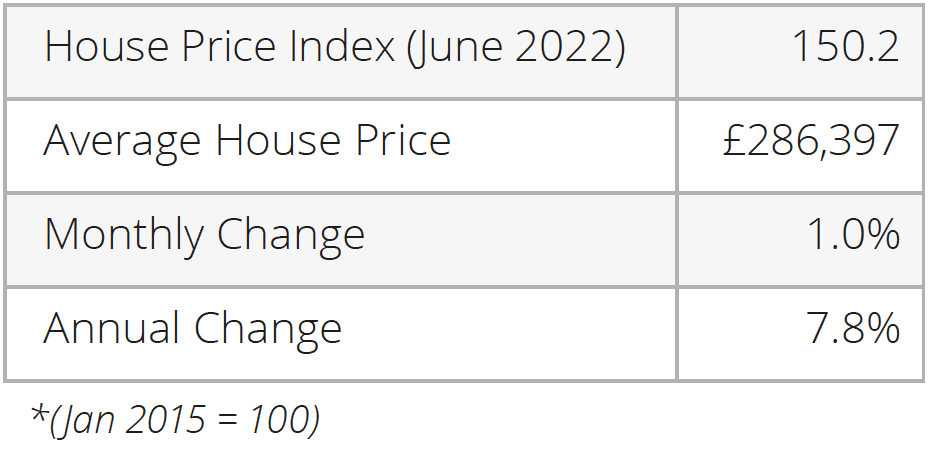

House prices: Headline statistics

Source: The Land Registry

Release date: 17/08/22

Next data release: 14/09/22

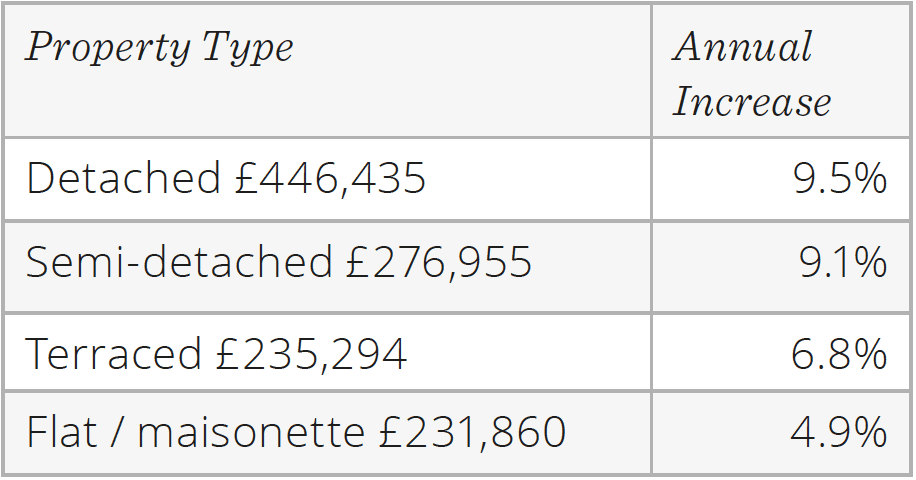

Average monthly price by property type – June 2022

Source: The Land Registry

Release date: 17/08/22

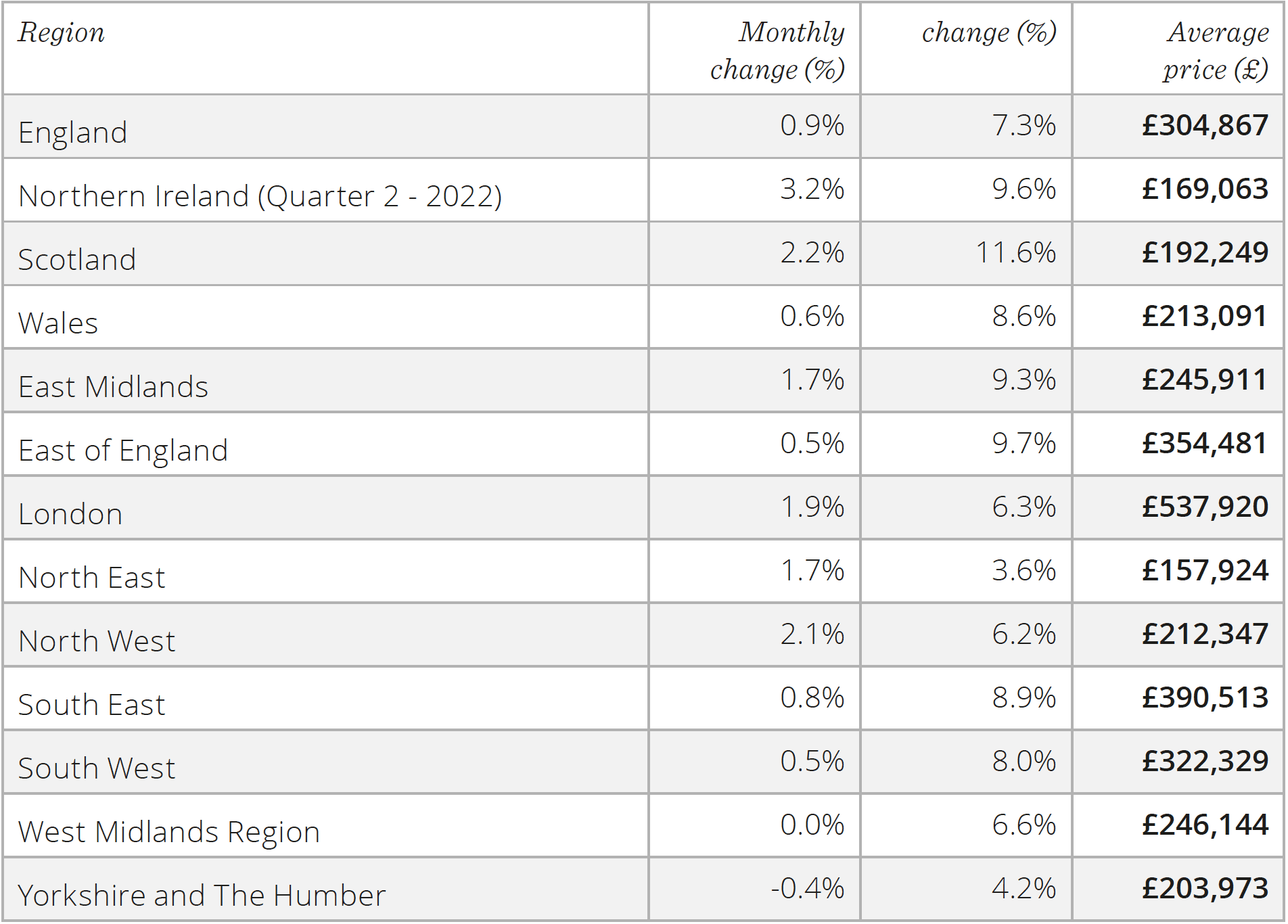

House prices: Price change by region

Source: The Land Registry

Release date: 17/08/22

Next data release: 14/09/22

Housing market outlook

“Some of the drivers of the buoyant market we’ve seen over recent years – such as extra funds saved during the pandemic, fundamental changes in how people use their homes, and investment demand, still remain evident. The extremely short supply of homes for sale is also a significant long-term challenge but serves to underpin high property prices.

Looking ahead, house prices are likely to come under more pressure as those market tailwinds fade further and the headwinds of rising interest rates and increased living costs take a firmer hold. Therefore, a slowing of annual house price inflation still seems the most likely scenario.”

Russell Galley, Managing Director at Halifax

Source: Halifax, August 2022

Important Information

All details are correct at the time of writing (17 August 2022).

Contains HM Land Registry data © Crown copyright and database right 2022. This data is licensed under the Open Government Licence v3.0.

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK.