corporate financial planning.

we help organise your business’ finances

no matter how good your business idea, or how successful that business becomes, its future may depend on how well you have prepared for the unexpected.

We understand that it can be hard to prepare for the unexpected, with how busy you are running your organisation, so let us help you through corporate financial planning.

Our team of experienced financial planners can help you to:

Protect your business against the unexpected loss of shareholders and key people

Manage your workplace pension scheme in a tax-efficient manner

Keep up to date with policy changes

expert advice

how well protected is your business?

If you think about your most important people. Now, think about the skills they have and the knowledge of your business that these key individuals possess.

What would you do if you unexpectedly lost them to illness or sudden death?

Are they replaceable?

And at what cost to your business?

The death or serious illness of a key individual can have significant consequences to your business, such as:

Loss of profits

Loss of key clients/contacts

By corporate financial planning early, you prevent the risk of your business suffering later in the event of someone falling ill or suddenly dying.

expert advice

how to protect your business from unprecedented financial difficulties

shareholder protection

You may have the costs of recruiting a replacement for the shareholder within the business.

Shareholder Protection can help by setting out how shares are managed if a shareholder passes away. It is advisable to have a solicitor draft a shareholder agreement, covering what the shareholders within the business would like to happen in the event of their death or critical illness.

The Shareholder Protection insurance policy can also include critical illness and is taken out on the lives of each shareholder by either fellow shareholders, or the business.

Should a shareholder die or become critically ill, pay-outs can be used to purchase the shares from the deceased’s beneficiaries, or from the critically ill shareholder.

business loan protection

It is important to note that loan agreements can include clauses that trigger the immediate repayment of the loan, in the event of a key individual leaving the business, even in the event of death or critical illness. Even if the loan is not payable on demand, the loan will still need to be repaid up until the term ends.

Many businesses will carry some form of commercial debt and the average business borrowing stands at £200,0001. This can include overdrafts, commercial loans/mortgages or directors’ loan accounts.

Furthermore, 54% have given personal security for their business borrowing. Therefore, many business owners are having to expose themselves and their families to the loan risks.

These types of liabilities can be protected against both death or a diagnosis of a critical illness. Our corporate financial planning team can discuss protection policies with you, that pay out a lump sum on either death or critical illness. This pay-out can allow the business some breathing space and allow them to clear the debt, should they wish to do so.

1Legal and General, State of the Nation’s SME Report 2021

relevant life plans

Relevant Life plans provide cost effective life assurance for employees and directors alike.

They are particularly useful for business owners as they can provide life cover for themselves, paid for by the business with no adverse tax implications.

Furthermore, in the event of death, the sum assured can be paid without impacting on their estate from an inheritance tax perspective.

This type of policy is most suitable for smaller businesses that are not eligible for the ‘large group scheme’. Or, for businesses that are looking for additional perks on top of the existing group scheme.

Unlike other policies and schemes, the relevant life plans are considered to be ‘non-registered’ and therefore are not associated with other pension regulations, such as the Lifetime Allowance.

key person insurance

Key Person insurance is a policy that helps to safeguard a business against the financial impact of death, terminal illness or critical illness of a key person during the term of the policy. It will usually cover you for recruitment and training costs, as well as the value of lost business.

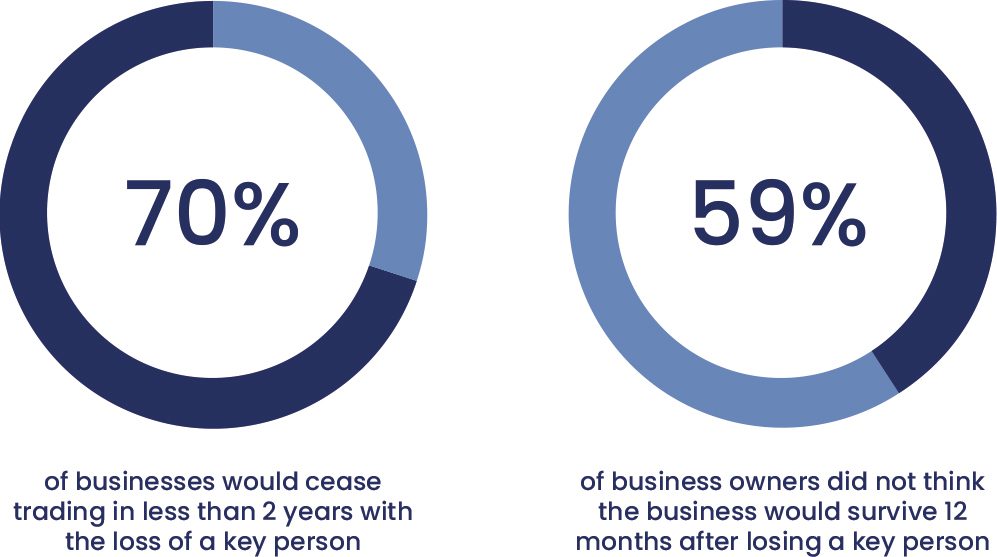

The death of a key person could have a significant impact on your business.

managing group pensions

It is well known that most people are not saving enough for retirement and, as a result, may not have the standard of living in retirement that they would like.

As a business owner, how are you supporting your employees to plan for their retirement? There are a range of potential solutions that will provide both you, and your employees, with tax-efficient retirement benefits.

Auto Enrolment

Auto Enrolment makes it compulsory for employers to automatically enrol eligible workers into a pension scheme and pay contributions into the pension scheme on behalf of the employee, as well as the employer.

There are minimum contribution rules for both you, as the employer, and your employees. These levels are currently 3% from the employer and 5% from the employee (including tax relief provided by the Government).

Pension schemes vary in terms of fees, expenses and the investment approach. If you need help setting up pension schemes that are auto enrolment compliant, one of our advisers would love to help.

Enhancing your recruitment and retention proposition

You know that your people are your greatest asset and that when they are fully engaged, they can be your best brand ambassadors.

Employee incentives can be the key to attracting and retaining the right people that will help you to drive your business forward.

The package that you provide is completely dependent on what is appropriate for you and your business. Our financial advisers can help you create bespoke packages for your business.

expert advice

preparing to sell your business?

If you are preparing to sell your business, the more time you prepare, the better the outcome is likely to be.

Many company owners put in a lifetime of hard work into building their business, only to throw away some of the rewards by failing to fully consider how they will exit.

Putting plans in place for the sound management of the business over several years will add value to your business, and allow you to begin your exit relatively quickly, and as smooth as possible when the time is right.

Aim for a year-on-year increase in profits

As business owners, we typically look to minimise profits to minimise the Corporation Tax we pay. Whilst this makes sense in the short-term, it could harm your business’ perceived value.

Look to expand your range of customers and suppliers

If you rely on a few key customers, this can undermine your business’ value.

Maximise your relief for Capital Gains Tax (CGT)

You may be able to claim entrepreneurs’ relief, which reduces the amount of CGT you would otherwise be liable for.

Accurate information

Ensure your accounts are in order and up to date, to give a true picture of the business. This will really save time when it comes to any due diligence that may be required later in the exit process.

Long-term contracts

Aim to tie key customers, suppliers and employees to long-term contracts.

Seek specialist tax advice

If your business holds a substantial amount in property, shares or cash in the bank account, these may disqualify you from entrepreneurs’ relief, so seeking specialist tax advice can be extremely beneficial.

Please note

The value of pension sand investments, and the income they produce, can fall as well as rise. You may get back less than you invested.

The Financial Conduct Authority does not regulate on inheritance tax planning, tax planning, trusts, auto enrolment, employee benefits and legal advice.

Tax treatment varies according to individual circumstances and is subject to change.

drop us a line

You can read a copy of our Privacy Notice by clicking here.

kind wealth

adds value

When deciding the fees we charge for advice we want to be sure you receive value for money and that the solutions we recommend are likely to deliver your objectives.