protection.

we help you to prepare for the unexpected

protecting you and your family from unforeseen circumstances is vital to your financial security

We cannot prevent the unexpected from happening, but we can help you be prepared through our protection planning advice services.

We will review your current protection policies and offer tailored solutions for you and your family, to provide you with peace of mind.

Taking action to protect your family now could save you money in the long term, as protection policies will invariably cost more as you get older.

expert advice

areas of protection that we can help with…

Life insurance

Helping your family cope if the worst should happen to you by providing a lump sum or income upon death.

Critical illness

A lump sum to help if you are diagnosed with specific conditions.

Income protection

Protect your monthly income if you are unable to work because of an accident or illness.

Private Health Insurance

Fast access to medical professionals when you need it.

Long-term care

Solutions to help deal with the costs associated with care for you or a relative.

expert advice

protecting your greatest asset – you!

You will most probably be familiar with how you protect your property, using buildings and home contents insurance. But are you as familiar with protecting your greatest asset – you?

A mortgage is likely to be the greatest financial commitment most people make. Your home relies on your income to repay the loan.

Events that could stop you from earning enough to repay your mortgage are:

Illness

An accident

A serious illness – such as cancer, a stroke or a heart attack

Death

You may have provisions in place. However, have you considered whether they would be sufficient and how long they would last? The first step we take is to check what you have already and how that contributes towards the solution.

Should you need to build on your existing plans, our advisers will always consider your overall objectives and budget.

So, is protection only about your mortgage?

The first aim of protection is to help you keep your home. The second aim is to maintain your, and your family’s, standard of living should something terrible happen.

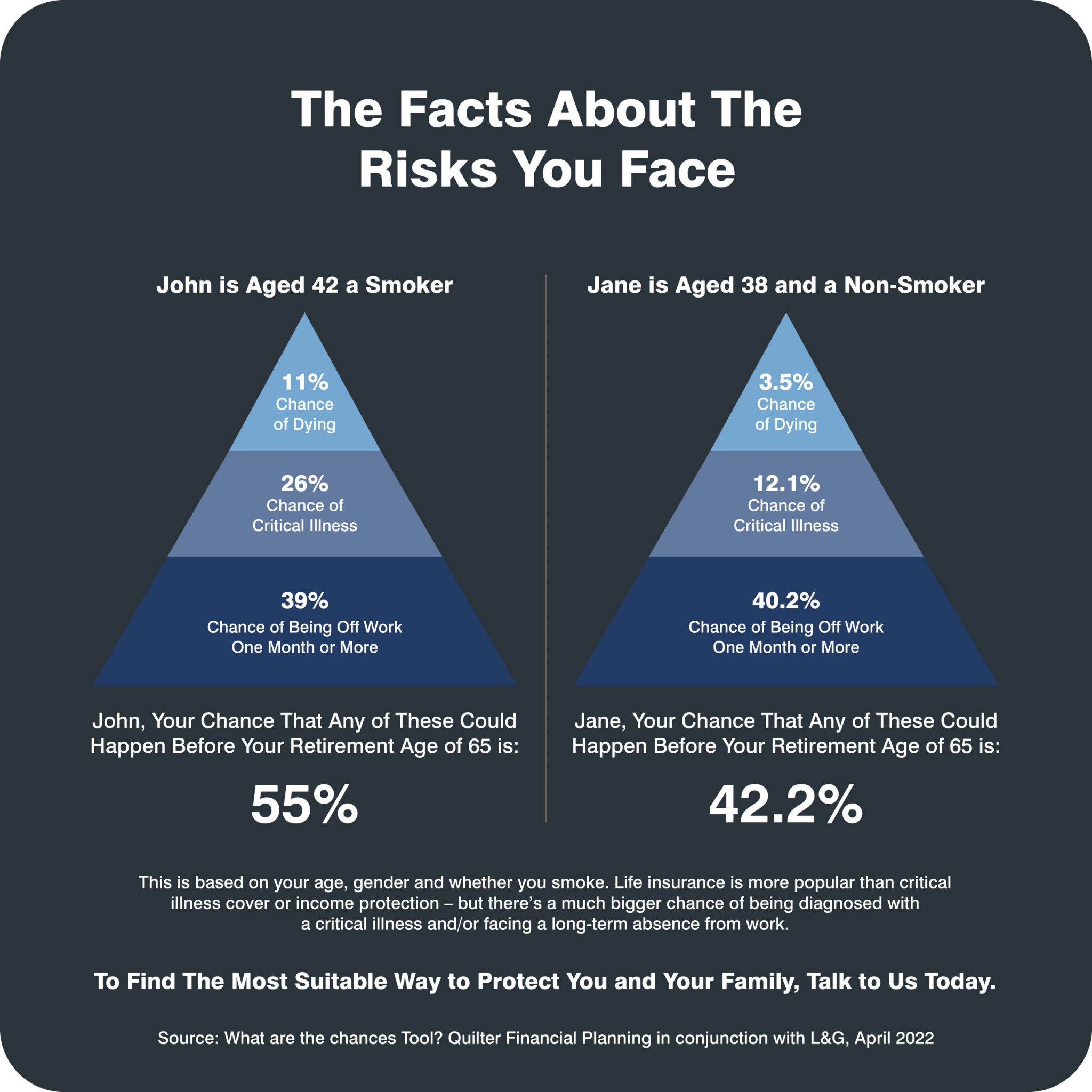

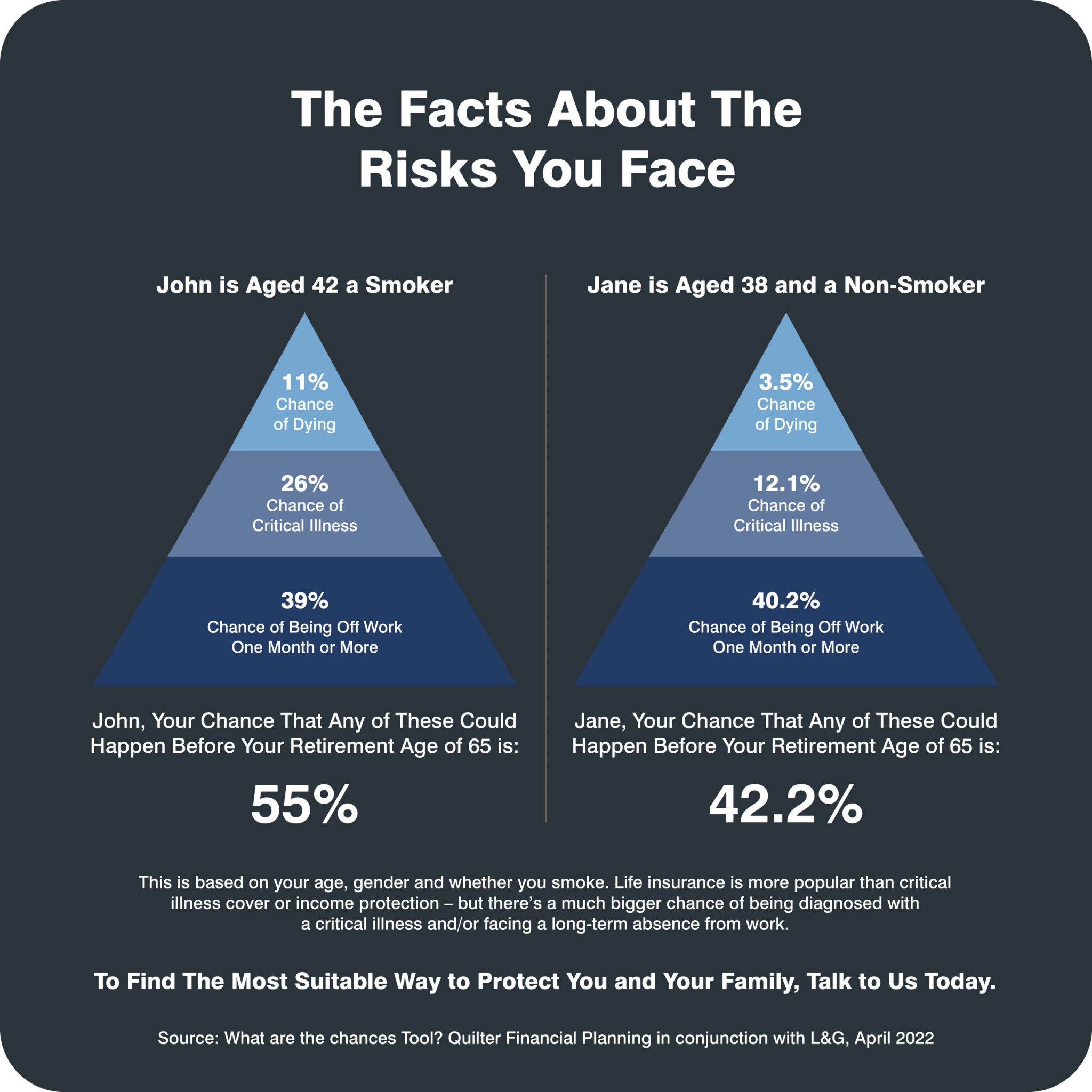

The facts about the risks you face – what are the chances?

our services

income protection

We all like to think that it will never happen to us. Unfortunately, though, there is a very real risk that it could happen to us all. Therefore, it is vital that we consider the financial impact if you were unable to go to work through injury or illness, or even worse, pass away.

Both John and Jane have a 39% chance or greater of being off work for a month or more. You may be thinking that a month would not have a financial impact. However, as can be seen from Aviva’s 2021 Claims Report, the average duration of an income protection claim was 6 years and 11 months.

If you are unable to work due to accident or injury, the government support, known as Statutory Sick Pay, is £109.40 per week in the 2023/24 tax year, which is paid for up to 28 weeks.

If you are still unable to work for longer than 28 weeks, the government support, known as Universal Credit, is up to £368.74 per month in the 2023/24 tax year, if you qualify for Universal Credit.

If you would not be able to survive on this level of income, then please do speak to one of our Financial Advisers about Income Protection.

our services

life insurance

Nobody likes thinking about their own death. Unfortunately, death is one of the few certainties in life. Therefore, it is important to ensure that your family are looked after if you were to pass away earlier than expected. For example, whilst you are still working, and your income is being used to repay your mortgage.

Life insurance pays out a lump sum that can be used by your family to pay off debts, such as your mortgage, to relieve the financial pressures of your death on the family. Furthermore, it means that your family are able to stay in the family home, rather than having to sell the family home to repay the mortgage, at a time when they are already vulnerable.

In addition, if your family relied on your income to meet their standard of living, life insurance can be used to pay out a lump sum or income that can be used by your family to continue with the same standard of living, rather than having to make compromises.

Your financial adviser will be able to work with you to establish the amount of life insurance you require, based on your circumstances and available budget.

frequently asked questions

What protection do I need?

Your adviser will work with you to determine which protection policies are suited for your circumstances and budget.

As a minimum, you should think about Income Protection and Life Insurance. Income Protection ensures that your income is replaced if you are unable to work for the long-term due to an accident or illness. This allows you to continue to pay your bills and, if applicable, mortgage repayments.

Life Insurance can pay out a lump sum on death, allowing your family to pay off any debts that you may have and reducing the financial burden upon your family in the event of your death.

What age should I take out protection?

Life insurance, critical illness and income protection can all be purchased at any age. However, as you get older, policies can become more expensive. Therefore, purchasing when you are still relatively young will keep the monthly cost lower.

drop us a line

You can read a copy of our Privacy Notice by clicking here.

kind wealth

adds value

When deciding the fees we charge for advice we want to be sure you receive value for money and that the solutions we recommend are likely to deliver your objectives.