Responsible investing is becoming a more popular discussion with our clients. In particular over the past 18 months, as clients are starting to think more about the future and what they can do to help the environment.

As a result, more awareness and changes in the industry have occurred and led a path for wider discussions around responsible investment with clients.

There is no denying that we all care about the environment and social issues, but now more and more investors are interested in where their money is being invested and what it’s being used for. After all, it makes sense to know what your money is being used for and that it is aligned with your values and beliefs, as well as providing an adequate return.

The appetite for Responsible Investing has increased considerably over the recent years. According to an article in the Financial Times, net assets held in UK domiciled ESG/responsible investment funds increased from £29bn at the beginning of 2017 to £71bn by the end of 2020, including active and passive funds. A prime example that investors are interested more than ever as to where they are invested.

What is Responsible Investing and ESG?

Responsible investing is an investment strategy that incorporates environmental, social, and governance (ESG) factors in investment decisions. Examples are:

Environmental factors such as resource, water, and land use, pollution, emissions, climate change, and waste.

Social factors such as human rights, gender equality, health and safety, supply chain management, and consumer protection.

Governance factors such as governance of an organisation. Examples include board composition, executive remuneration, internal controls, and balancing the interests of all shareholders.

When it comes to investing, investment managers will have the ability to be able to pick companies that align with the above factors. In order to be able to determine a company’s approach, the Investment Association has provided some key principles.

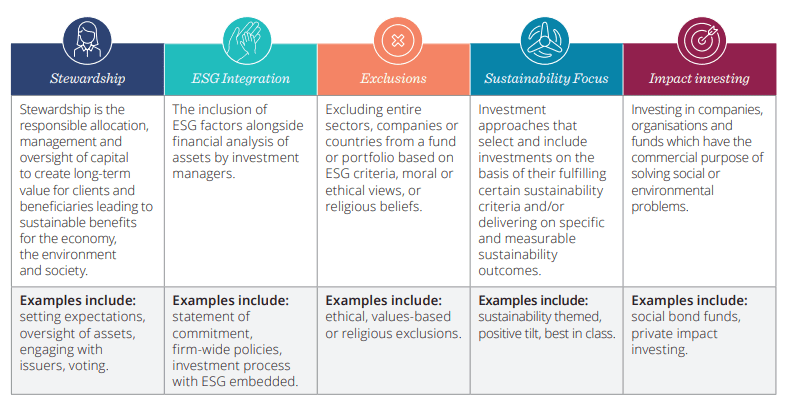

The Investment Association definitions of ESG principles

The consideration of ESG factors is of growing importance in asset management, with successful approaches increasingly being used to great advantage: both to enhance returns and, perhaps more importantly, to understand and manage risk. Furthermore, understanding how much integration of the ESG factors into individual companies, as well as the investment fund, will help differentiate between ESG aligned and non ESG aligned companies.

At Kind Wealth, we hold in depth discussions with our clients regarding responsible investing and how we can help with incorporating their preferences and beliefs into their investments. We enjoy being able to ensure our clients are saving for their futures, but also satisfying they personal choices through responsible investing.

We believe our approach to responsible investment provides our clients with the perfect blend of insight, choice and value. Whether responsible investment is fundamentally important to you, or you’re simply curious, our service has been designed with you in mind.