The global pandemic and the War in Ukraine have both caused significant disruption to the world’s supply chains (i.e. food, energy and transport to name a few), meaning the price the consumer has to pay for most goods and services has gone up significantly.

When the general price of goods and services increase in an economy, we call this inflation. We should expect a low level of inflation in a healthy and growing economy, however it is always important to consider the effects of inflation when making or reviewing your financial plan. Over the long term, inflation, has averaged around 2.5%, yet in the previous 12 months to April 2022 inflation has soared to 9% and the Bank of England has forecast that this is likely to top 10% later this year. These levels of inflation can be devastating for your hard earned savings, so when you look at what your cash savings will be worth at the end of a given period, don’t be fooled into thinking the value will still have the same purchasing power as it does today.

Petrol – Up 31%

If you spent £200 a month on petrol in 2021, it will now cost you £262.

Gas – Up 95%

If your monthly gas bill was £100 in 2021, it will now cost you £195.

Data based on ONS figures to April 2022.

* Source; Saltus Wealth Index, May 2022

Inflation may peak but prices will remain high

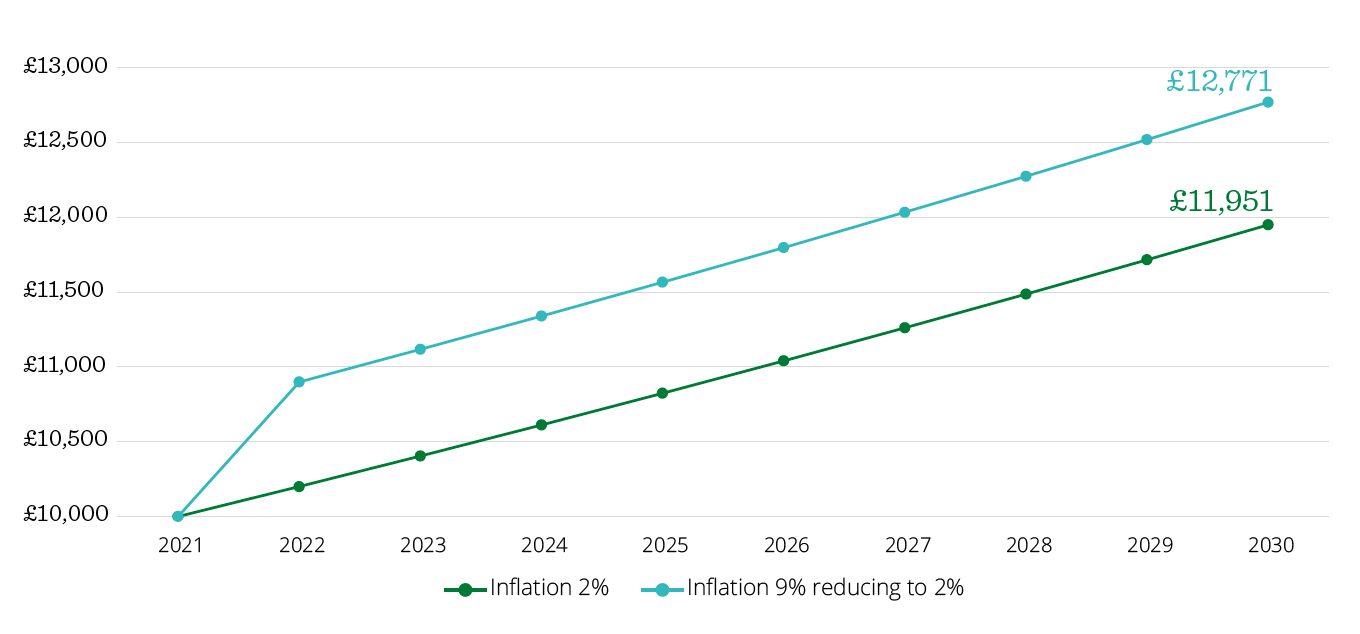

High levels of inflation, even just for a short period can have powerful consequences. On the right you can see how the price of a £10,000 basket of goods would stay high even if inflation returned to the Bank of England’s target of 2%, and what the price would have been had inflation stayed at 2%.

As you can see, after only one year of high inflation, the impact means higher prices are likely to remain for the long term, with prices unlikely to reduce.

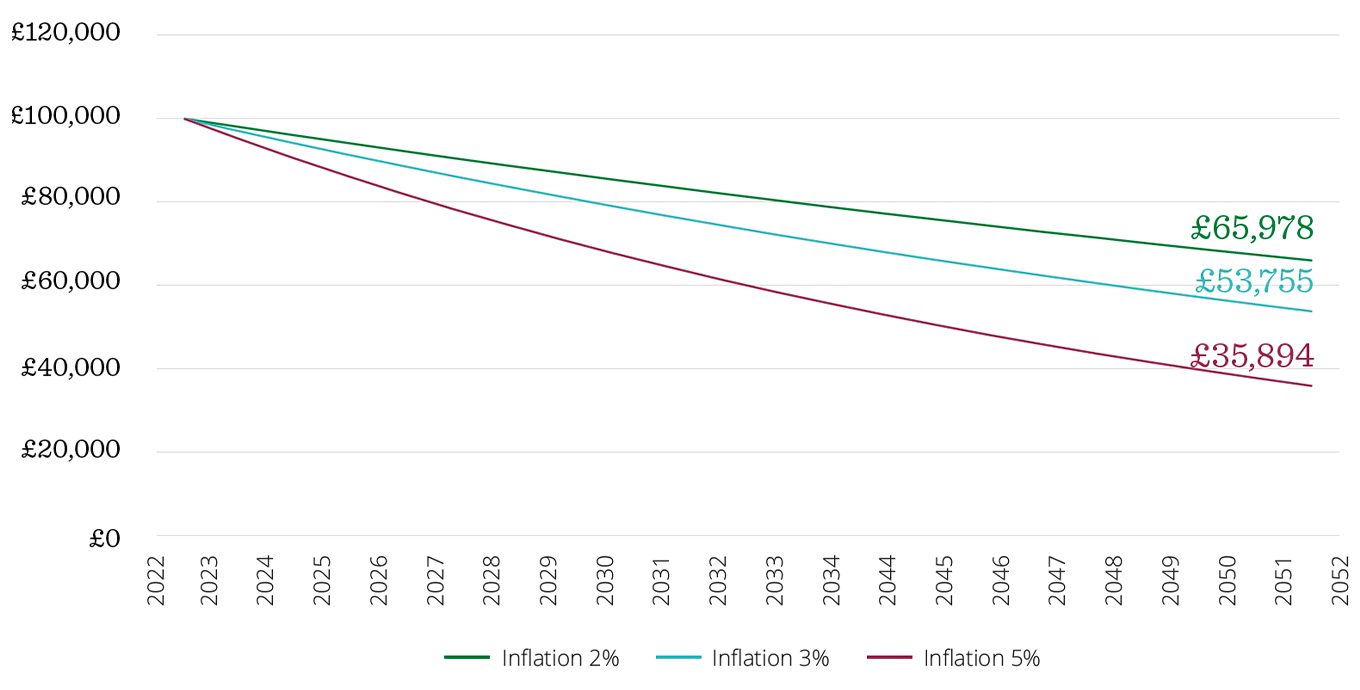

What does this mean for £100,000 in savings?

In this example we show how quickly the value of £100,000 in cash would be eroded if inflation remained high for just three years.

Do not underestimate the long-term impact

Savers often underestimate how much damage inflation can do over the long term, even at modest levels. This chart demonstrates how inflation of just three percent can reduce the value of cash by almost 50% over 30 years, so if you are saving for your retirement, then you must be aware of how corrosive this can be to your cash savings. If you already have a financial plan in place, this reinforces the benefit of sticking to it, if you do not, then you should take action now.

What action can you take?

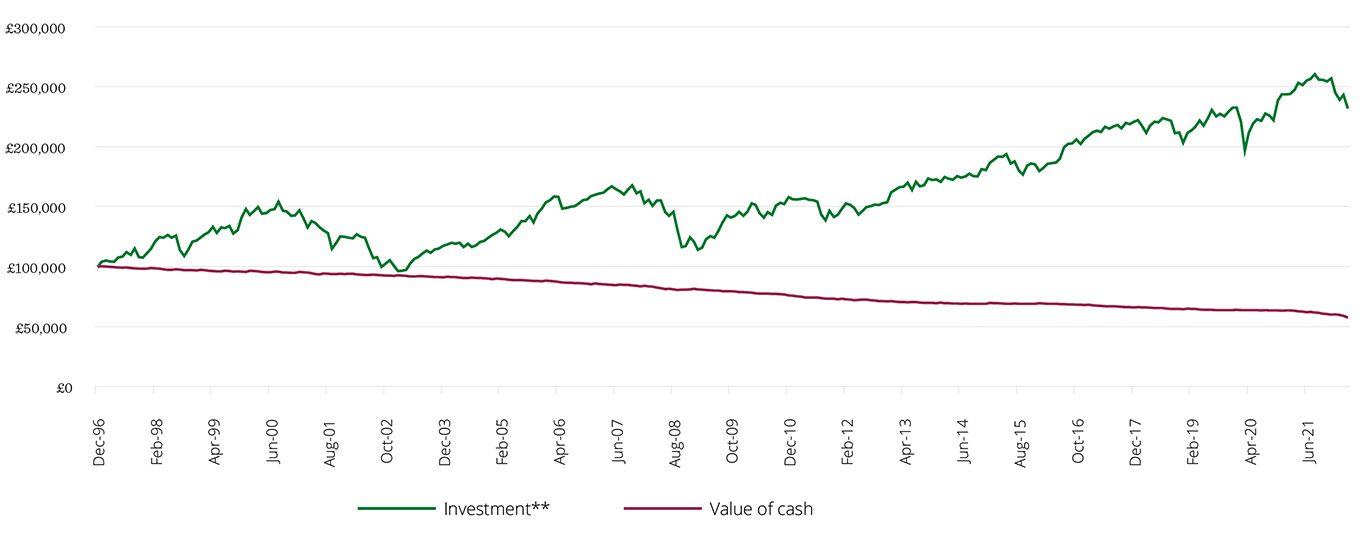

Investing over the medium to long term can typically mitigate the effects of inflation and your financial adviser can recommend a selection of assets that are appropriate for the level of risk you want to take. Once you’ve committed to your financial plan, then remaining invested for the long term is key to beating inflation.

The chart below shows how £100,000 invested in the Investment Associations 40-85% shares sector would have more than doubled in value since the mid 1990s, even after adjusting for inflation, which was 2.18% (annualised) over the period*. During this time, the sector delivered an annualised return of 5.67%**. Conversely, had the £100,000 been left as cash it would have almost halved in value, after adjusting for inflation.

*Based on CPI data from ONS.

**Based on the Investment Associations 40-85% shares sector.

The value of pensions and investments can fall as well as rise. You may get back less than you invested.

Finding the right balance

Your financial adviser can develop a financial plan to help you achieve your financial goals, including a suitable approach to help reduce the impact of inflation.

Ensuring you hold the right balance of cash and stocks and shares for your needs and risk profile is an important part of that conversation. So, if you have savings in bank accounts, cash ISAs, Premium Bonds, or even under the mattress, you should consider:

Are you comfortable that your cash savings have little protection against inflation?

Will your cash savings enable your to meet your long term savings goals or is there a better alternative?

Speak to your financial adviser today to find out more about the solutions available to you!

Your investment may fall or rise in value and you may not get back what you put in. Past performance is not a guide to the future.